Are Housing Prices Going to Continue to Go Up in the Bay Area for the Next Few Years

How Is The Housing Market In California Right Now?

Rising interest rates dampened the sales in the California housing market in September. Home sales have fallen for 15 straight months year over year, and it was the second time in the last three months that sales fell more than 30% from the previous year, according to C.A.R. The monthly 2.5 percent drop in sales was worse than the 43-year long-run average of 0 percent fall between August and September.

Sales in all price ranges fell by 25% or more year on year, with the sub-$300,000 price category decreasing the highest (36.7%). Million-dollar house sales plummeted by double digits for the fourth month in a row, with the high-end market sector down 25.6 percent from the same month last year.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 305,680 in September. September's sales pace was down 2.5 percent on a monthly basis from 313,540 in August and down 30.2 percent from a year ago when 438,190 homes were sold on an annualized basis.

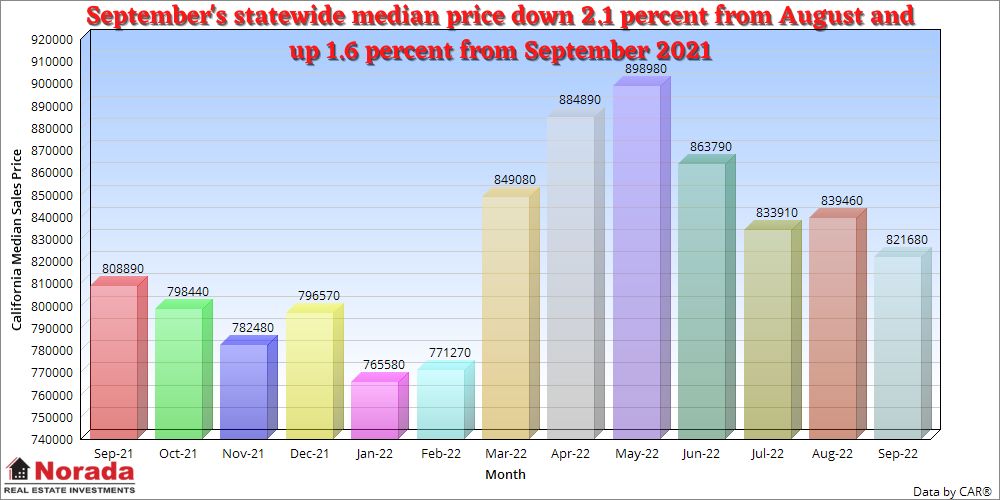

California home prices increased on a year-over-year basis, but the rate of rising was quite slow compared to earlier this year. September's statewide median home price was $821,680. It was the fourth consecutive month with single-digit yearly growth, with a 1.6 percent gain year over year. The statewide median price increase rate of less than 2% was much lower than the 6-month average growth rate of 6.7 percent recorded between March 2022 and August 2022.

<<<Also Read: Will the US Housing Market Crash? >>>

"With interest rates rising rapidly since the beginning of the year, buyers and sellers are having difficulties adapting to the market's new 'normal,'" said C.A.R. President Otto Catrina, a Bay Area real estate broker, and REALTOR®. "As the market continues to evolve in the next 12-18 months, REALTORS® will be playing an ever-more important role as trusted advisors to guide their clients through the complicated buying and selling process and help them overcome their obstacles during these challenging times."

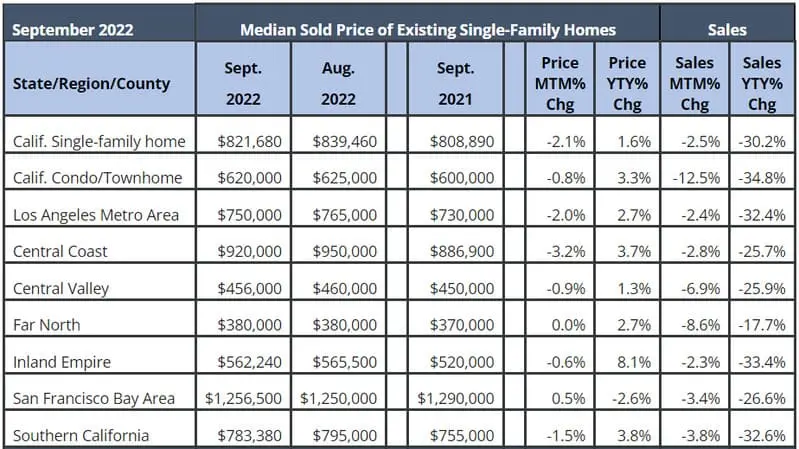

At the regional level, home sales in all major California regions declined from a year ago, with four of the five major regions dropping more than twenty-five percent on a year-over-year basis. Home prices rose in all major California regions except San Francisco Bay Area.

- The San Francisco Bay Area had a year-over-year price decline of 2.6 percent, with the median price being $1,256,500.

- The Central Coast had a year-over-year price gain of 3.7 percent, with the median price being $920,000.

- Southern California had a year-over-year price gain of 3.8 percent, with the median price being $783,380.

- The Central Valley had a year-over-year price gain of 1.3 percent, with the median price being $456,000.

- The Far North had the highest year-over-year gain of 2.7 percent, with the median price being $380,000.

Looking at the current market shift, C.A.R. has reduced its 2022 housing prediction. The supply constraints and higher home prices will bring California home sales down slightly in 2022, but transactions will still post their second-highest level in the past five years. The California median home price is forecast to rise 5.2 percent to $834,400 in 2022, following a projected 20.3 percent increase to $793,100 in 2021 from $659,400 in 2020.

Existing, single-family home sales are forecast to total 416,800 units in 2022, a decline of 5.2 percent from 2021's projected pace of 439,800. Housing affordability is expected to drop to 23 percent next year from a projected 26 percent in 2021. Furthermore, as the trend of remote working continues, a change in housing demand to more affordable places will keep prices in check and prevent the statewide median price from climbing too quickly in 2022.

Weekly Real Estate Trends and Forecast in California [October 1, 2022]

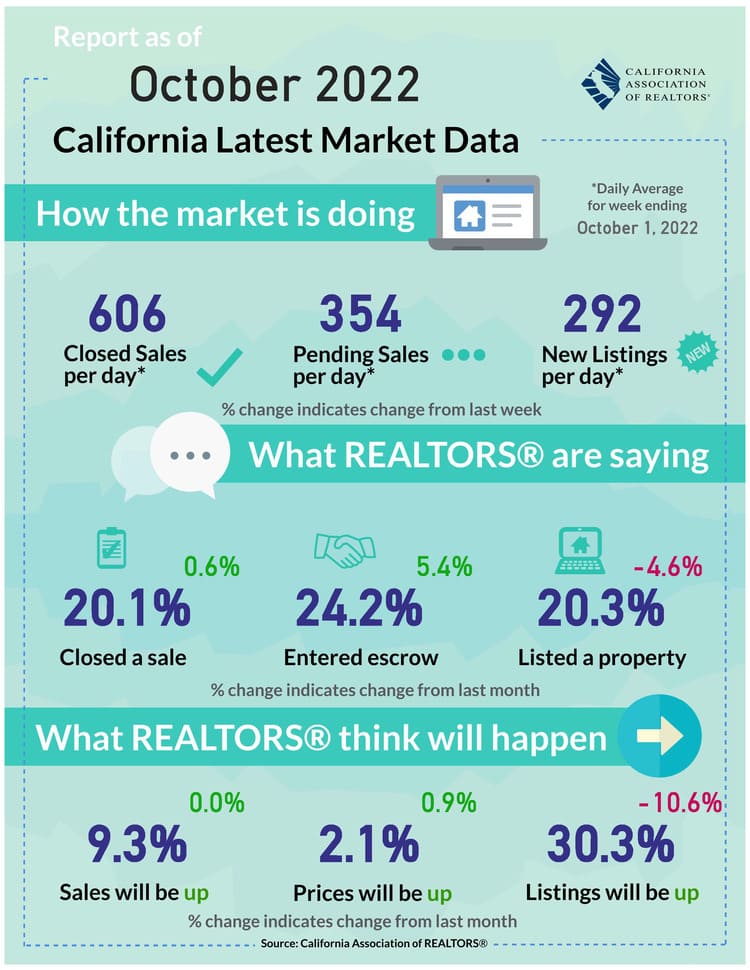

According to C.A.R., buyer demand is dwindling as mortgage rates rise, reducing consumer spending power. And, with the new inflation reading coming in hot, we should expect the Fed to raise interest rates more at their future meeting. Furthermore, REALTORS® polled over the last month are becoming less hopeful, and buyers and sellers are still adjusting to the new market climate.

However, the market has become less competitive, and more sellers are willing to negotiate or offer buyer incentives, and despite a modest recession forecast for 2023, the long-term prospects for continued price growth in California may continue to attract buyers who still qualify at higher rates but have been sidelined during the previous two years of frenzy.

Since April 2022, the percentage of REALTORS® who believe sales will increase in the foreseeable future has been steadily falling, reaching only 4.6% in October. This is the lowest reading since C.A.R. began polling its members shortly after the pandemic began. The study also revealed that fewer members expect listing prices to climb, with the proportion dropping from half of the respondents at the start of the year to one in five this month.

The percentage of people who believe prices will rise continues in the low single digits, as it has for the last five months. Members indicate reduced demand, but a lack of listings keeps inventory reasonably tight. According to C.A.R.'s most recent monthly REALTOR® survey, the percentage of agents who have sellers who are hesitant to list their home has been rising upward since May, reaching its second-highest level this year at 36% in October.

Furthermore, 25% of REALTORS® polled reported having a customer withdraw their house from the market entirely in October, the highest number since the survey's inception more than two years ago. More REALTORS® are reporting price decreases for sellers who kept their homes on the market after they rose steadily from a low of 5% in April. However, the proportion of responders whose clients reduced their asking price in October fell from 43% in September to 39% in October.

Is the Housing Market Cooling Off in California?

The California housing market sizzled last year to break all records. It was a hot seller's real estate market. According to Zillow, at the state level, California's housing market remains the most valuable in the country, with a total value of $9.24 trillion as of last December, accounting for more than a fifth – 21.3 percent – of the national total. However, California's overall value growth of $1.38 trillion in 2021 represents only "20.1 percent" of the overall national growth of $6.9 trillion – somewhat "underperforming" by about -5.5 percent relative to its total weight, particularly given the extreme growth seen in other states.

Here's a rundown of the California housing market demand for the week ending October 1, 2022.

California Active & Closed Median Home Prices Trends

- Existing SFR Active Listings = 47,000

- Year-to-Year Existing SFR Active Listings Growth = 24.8%

- Median New Listing Price = $745,000

- Year-to-Year New Existing SFR Median List Price Growth = 6.4%

- Month-to-Month New Existing SFR Median List Price Growth = -0.7%

- Median New Listing Prices Per Sq. Ft. = $416

- Existing SFR Median Closed Prices = $729,000

- Year-Over-Year Existing SFR Median Closed Price Growth = 1.3%

- Month-to-Month New Existing SFR Median Closed Price Growth = -1.6%

California Housing Market Competitiveness

- % of Active Listings w/Reduced Price = 45.1%

- Median Reduction on Reduced-Price Listings % = -5.6%

- % of Sales Closed Below List Price = 61.4%

- Median Reduction on Reduced-Price Sales % = -6%

- % of Homes Closed Above List Price = 28%

- Median Overage on Homes Closing Above List = 2.9%

- Median Days on Market for Closed Sales = 27

- Median Days on Market for Active/Unsold Homes = 46

Will the California Housing Market Crash?

While Californians have endured exorbitantly high property prices for years, at least some homebuyers appear to have reached their breaking point. Amidst the harsh reality of rising mortgage rates (already over 6 percent) and inflation eroding their wages, many people are yearning for a new sort of paradise: one where they don't have to worry about paying their bills.

According to most experts, the market will continue to see moderate buyer demand and a positive rate of home price appreciation, despite a significant cooling from the extreme heat of early spring 2022. However, California is no longer a desirable location to live in since purchasers have endured exorbitantly high housing prices for years, and at least some homebuyers appear to have hit their breaking point.

Each month C.A.R. surveys 1,000 California consumers regarding their sentiments about various aspects of the housing market or the economy that directly impact housing to create a California Housing Sentiment Index. In September 2022, the overall housing sentiment index was 55 (down 10% from last month). It showed that consumers acknowledged the current market challenges and felt increasingly pessimistic about homebuying opportunities.

Consumers who thought it was a "Good time to buy" dropped to 14% in September. There is some evidence that inventory is gradually starting to thaw, but real estate faces many variables in the months ahead. Here's what consumers feel at this time. The 2022 California housing market forecast has been revised to 380,630 units sold and a statewide median price of $863,390.

Is it a good time to buy a home in California?

Consumer optimism declined in early September, according to C.A.R.'s monthly Consumer Housing Sentiment Index, as interest rates rose. The share of respondents who thought it was a good time to buy a home increased month over month for the fourth consecutive month to 14 percent, bringing the Housing Sentiment Index to 55. Meanwhile, those who believed it was a good time to sell a home fell to 51%, down 5% from August 2022. 73% of California consumers expected the state's overall economic conditions to worsen over the next year, while 80% expected interest rates to rise.

Is it a good time to sell a home in California?

According to the survey, close to two-thirds (51 percent) of Californians believe now is a good time to sell a home. That's a decrease of 5% over the August 2022 poll. Less than one-third of the consumers (30%) who participated in the survey still feel that home prices will continue to rise in the 12 months. That's a decrease of 6% from the previous month. Less than one-third of the people are optimistic about the economy's recovery. About 27% (-9% from last month) believe that economic conditions will improve in the state over the next 12 months while 73% still have a gloomy outlook.

California Housing Market Forecast 2022 and 2023

California Housing Market Forecast for 2022

Supply constraints and higher home prices will bring California home sales down slightly in 2022, but transactions will still post their second-highest level in the past five years, according to a housing and economic forecast released today by the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.). They see a decline in existing single-family home sales of 5.2 percent next year to reach 416,800 units, down from the projected 2021 sales figure of 439,800.

The 2021 figure is 6.8 percent higher compared with the pace of 411,900 homes sold in 2020. The California median home price is forecast to rise 5.2 percent to $834,400 in 2022, following a projected 20.3 percent increase to $793,100 in 2021 from $659,400 in 2020. A supply-demand imbalance will continue to put upward pressure on prices, but higher borrowing rates and partial adjustment of the sales mix will likely limit the median price rise.

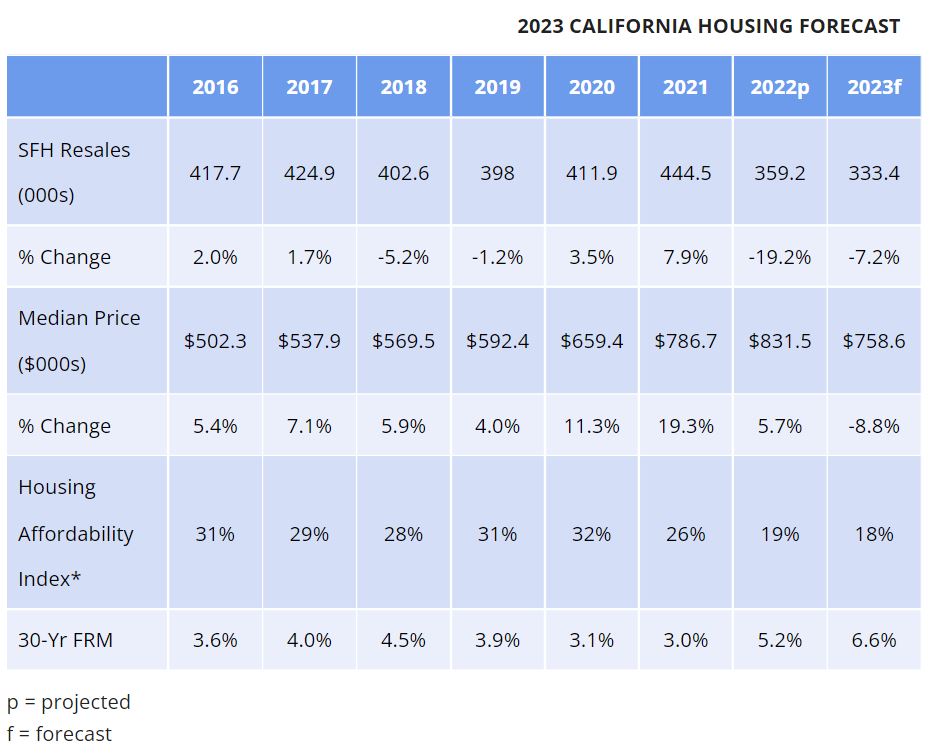

California Housing Market Forecast for 2023

Here's the California Housing Forecast for 2023 released by the C.A.R on October 12, 2022. A modest recession caused by an ongoing battle against inflation will keep interest rates elevated to suppress buyer demand and contribute to a weaker housing market in 2023, according to a housing and economic forecast released today by the CALIFORNIA ASSOCIATION OF REALTORS®. High inflationary pressures will keep mortgage rates high, reducing purchasing power and lowering property affordability for prospective purchasers in the coming year. As a result, housing demand and prices will fall throughout 2023.

- Existing, single-family home sales are forecast to total 333,450 units in 2023, a decline of 7.2 percent from 2022's projected pace of 359,220.

- California's median home price is forecast to decline 8.8 percent to $758,600 in 2023, following a projected 5.7 percent increase to $831,460 in 2022.

- Housing affordability is expected to drop to 18 percent next year from a projected 19 percent in 2022.

According to C.A.R.'s "2023 California Housing Market Forecast," existing single-family home sales will fall 7.2 percent next year to 333,450 units, down from 359,220 units in 2022. The forecast for 2022 is 19.2 percent lower than the 444,520 residences sold in 2021. The median home price in California is expected to drop 8.8 percent to $758,600 in 2023, after rising 5.7 percent to $831,460 in 2022 from $786,700 in 2021. Next year's median price rise will be slowed by a less competitive housing market for homebuyers and a stabilization in the mix of home sales.

According to C.A.R.'s 2022 projection, the U.S. gross domestic product of 0.5 percent in 2023, after a projected uptick of 0.9 percent in 2022. With California's 2023 nonfarm job growth rate at 1.0 percent, up from a projected increase of 4.9 percent in 2022, the state's unemployment rate will edge up to 4.7 percent in 2023 from 2022's projected rate of 4.4 percent.

Stubbornly high inflation and growing economic concerns will keep the average for 30-year, fixed mortgage interest rates elevated at 6.6 percent in 2023, up from 5.2 percent in 2022 and from 3.0 percent in 2021 but will remain relatively low by historical standards.

Let us look at the price trends recorded by Zillow over the past few years. Since the last twelve months, California home values have appreciated by nearly 8.7% — Zillow Home Value Index. ZHVI is not the median price of homes that are sold in a month within a geographic region. It is calculated by taking all estimated home values for a given region and month (Also called Zestimates), taking a median of those values, and applying some adjustments to account for seasonality or errors in individual home estimates.

It, therefore, represents the whole housing stock and not just the homes that list or sell in a given month. By this calculation, the current typical home value of homes in California is $769,405. It indicates that 50 percent of all housing stock in the area is worth more than $769,405 and 50 percent is worth less (adjusting for seasonal fluctuations and only includes the middle price tier of homes).

- Typical Home Value in California: $769,405 as of September 30, 2022

- 1-year Value Change: +8.7%

- 1.005 is the Median sale to list ratio as of August 31, 2022

- 52.5% Percent of sales over list price as of August 31, 2022

- 33.5% Percent of sales under list price as of August 31, 2022

Latest California House Prices & Sales Trends [September 2022]

Here are some of the key points of the California housing market report for September 2022 , according to C.A.R.

Existing-Home Sales Trends

- September's sales pace was down 2.5 percent on a monthly basis from 313,540 in August

- It was down 30.2 percent from a year ago when 438,190 homes were sold on an annualized basis.

- Year-to-date statewide home sales were down 16.5 percent in September.

- At the regional level, all major regions experienced sharp declines from last year.

- With four of the five major regions dropping more than 25 percent.

- Southern California had the biggest drop of all regions, with sales plunging 32.6 percent from a year ago.

- The San Francisco Bay Area (-26.6 percent), the Central Valley (-25.9 percent), and the Central Coast (-25.7 percent) also dipped more than 25 percent from last year.

- All but three counties tracked by C.A.R. posted sales drops from last September.

- 45 of them fell more than 10 percent, and 36 counties plunged more than 20 percent from the same month last year.

- Mono had the biggest drop in sales at -42.9 percent.

- Only three counties posted sales increases from last September, with Glenn gaining the most year-over-year at 63.6 percent.

California Home Price Trends 2022

- Median prices in all major regions continued to grow on a year-over-year basis except for SF Bay Area.

- Southern California led the way at a 3.8 percent increase, followed by the Central Coast at 3.7 percent and the Far North at 2.7%.

- In Central Valle, the median home price rose by 1.3%.

- In San Francisco Bay Area, the median home price dropped by 2.6%.

- In the Far North, the median home price dropped by 1.8%.

- Nearly two-thirds of all California counties experienced an increase in their median prices.

- Prices were up from last year by double-digits in five counties in September, as compared to seven counties in the prior month.

- Lassen (31.2 percent) recorded the biggest price increase of all counties.

- The median price in 17 counties dipped from the same month of last year, with Mariposa dropping the most at -25.4 percent.

California Housing Supply

- Housing supply in California improved from a year ago and was unchanged in September from the prior month despite a decline in housing demand.

- The statewide Unsold Inventory Index (UII) was 2.9 months in September 2022 from 1.9 months a year ago.

- The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

- With closed sales dropping more than 25 percent and pending sales falling over 40 percent, active listings have been staying on the market significantly longer.

- As a result, it led to a surge in for-sale properties by 51.5 percent in September.

Median Days & Sales Price to List Price Ratio

- The median number of days it took to sell a California single-family home was 22 days in September and 10 days in September 2021.

- C.A.R.'s statewide sales-price-to-list-price ratio was 97.7 percent in September 2022 and 101.9 percent in September 2021.

- It was below 100 percent for the second time since June 2020.

- Looking at sale-to-list percentages can help buyers and sellers get a sense of how to negotiate prices.

- A higher ratio of 100% or above shows a strong market favoring sellers.

- September's price per square foot was $404, up from $393 in September a year ago.

These monthly and yearly trend numbers can be positive or negative depending on which side of the fence you are — Buyer or Seller?

"September's sales and price declines reaffirm our forecast for next year," said C.A.R. Vice President and Chief Economist Jordan Levine. "High inflationary pressures will keep mortgage rates elevated, which will reduce homebuyers' purchasing power and depress housing affordability in the upcoming year. With borrowing costs remaining high in the next 12 months, a pull-back in sales and a downward adjustment in home prices are expected in 2023."

Housing Affordability in California

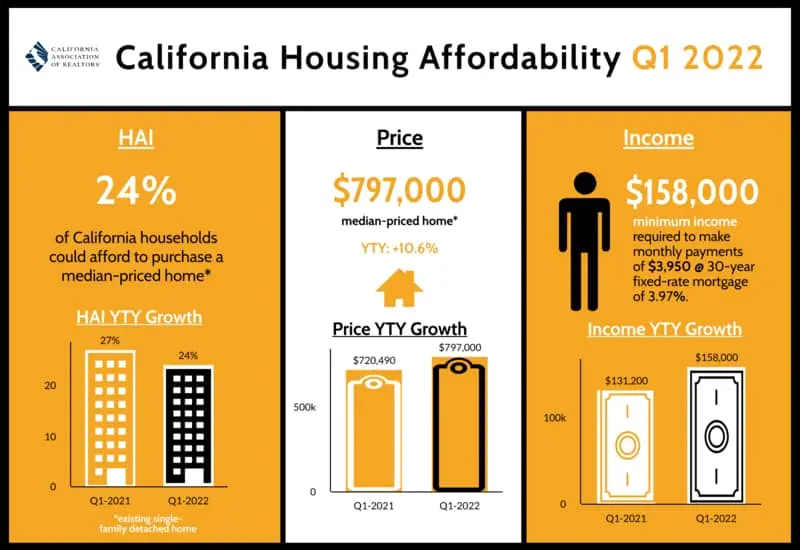

Housing costs have been on the rise in California, which has impacted affordability. Only twenty-four percent of California households could afford to purchase the $797,000 median-priced home in the first quarter of 2022, down from 25 percent in the fourth-quarter 2021 and down from 27 percent in first-quarter 2021.

According to C.A.R.'s Traditional Housing Affordability Index (HAI), the percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California in the first-quarter 2022 was down to 24 percent from 25 percent in the fourth quarter of 2021 but was down from 27 percent in the first quarter of 2021. The first-quarter 2022 figure is less than half of the affordability index peak of 56 percent in the first quarter of 2012.

C.A.R.'s HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. C.A.R. also reports affordability indices for regions and select counties within the state. The index is considered the most fundamental measure of housing well-being for homebuyers in the state.

- A minimum annual income of $158,000 was needed to qualify for the purchase of a $797,000 statewide median-priced, existing single-family home in the fourth quarter of 2022.

- The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $3,950, assuming a 20 percent down payment and an effective composite interest rate of 3.97 percent.

- The effective composite interest rate was 3.28 percent in the fourth quarter of 2021 and 3.08 percent in the first quarter of 2021.

- A minimum annual income of $148,000 was needed to make monthly payments of $3,700

- It included principal, interest, and taxes on a 30-year fixed-rate mortgage at a 3.28 percent interest rate.

- Thirty-two percent of home buyers were able to purchase the $640,000 median-priced condo or townhome.

- A minimum annual income of $126,800 was required to make a monthly payment of $3,170.

- Compared with California, nearly half of the nation's households could afford to purchase a $368,200 median-priced home.

- Which required a minimum annual income of $73,200 to make monthly payments of $1,830.

- Nationwide affordability was down from 54 percent a year ago.

References/Data Sources

- https://www.car.org/

- https://www.car.org/aboutus/mediacenter/newsreleases

- https://www.car.org/marketdata/data/countysalesactivity

- https://www.car.org/marketdata/marketforecast

- https://www.car.org/marketdata/marketminute

- https://www.car.org/marketdata/interactive/housingmarketoverview

- https://www.zillow.com/ca/home-values

- https://lao.ca.gov/LAOEconTax/Article/Detail/265

- https://sf.curbed.com/2020/3/23/21188781/sf-housing-market-coronavirus-covid-19

- https://www.ppic.org/publication/new-patterns-of-immigrant-settlement-in-california

- https://fox40.com/news/business/local-real-estate-market-slows-amid-covid-19-pandemic

- https://www.point2homes.com/news/us-real-estate-news/experts-california-real-estate-2020.html

- https://www.washingtonpost.com/business/2020/02/27/mortgage-rates-head-back-down-coronavirus-fears

- https://www.cnbc.com/2020/03/18/weekly-mortgage-applications-drop-over-8percent-as-interest-rates-jump.html

- https://www.usnews.com/news/business/articles/2020-03-25/business-fallout-companies-in-china-see-delays-in-reopening

- https://www.dallasnews.com/business/real-estate/2020/03/25/homeowners-who-cant-pay-their-mortgages-are-getting-help

- https://www.wfsb.com/news/businesses-considered-essential-under-stay-safe-stay-home-policy/article_53f8e0d0-6d17-11ea-a04d-57ecbb72c518.html

Source: https://www.noradarealestate.com/blog/california-housing-market/

0 Response to "Are Housing Prices Going to Continue to Go Up in the Bay Area for the Next Few Years"

Post a Comment